Did the EU try to spy on China’s EV makers under the guise of an official investigation?

Hello again, welcome back, thanks for dropping by.

It’s been a while since we took a look at the Chinese EV or NEV market so today it’s time for a quick glance at what has been going on and a round up of stories that are making headlines.

In January this year we commented on the decision by France to slap a pollution surcharge on China’s Electric cars – claiming their production wasn’t green enough. We surmised Chinese makers would either react by cutting prices or, continue their off shore expansion by building factories in Europe.

We’re not sure what happened to France’s proposal, after all it did come under heavy fire from several French EV makers whose production is based in China.

EU Asked China’s EV Makers for ‘Unprecedented’ Data

However last week the EU announced its decision on its investigation of China Govt subsidies to Chinese NEV auto makers.

Source

According to Chinese manufacturers, the European Union sought an “unprecedented” amount of information from China’s electric carmakers as part of its anti-subsidy investigation. Much of the data collected was tantamount to snooping or industrial spying under another guise it is claimed.

Unsurprisingly that resulted in surcharges being levied against various makers.

Our friends at Yicai Global covered that story, again with experts backing up our early theory that this would simply speed up Chinese investment in European countries.

EU Tariffs on Chinese EVs May Drive More Chinese Production Into Europe

The EU will impose provisional countervailing duties ranging from 17.4 percent to 38.1 percent on China-made EVs to offset local subsidies, the EU government said on June 12 following the conclusion of its anti-subsidy investigation launched in October last year

It’s conceivable this round of “sanctions:” on Chinese makers might help the EU coffers in general, it doesn’t seem to be helping some EU auto makers.

On june 6th this yer, Yicai (again) ran with this headline:

BMW, Cadillac, and Audi Slash Prices in China to Fend Off Local Carmakers

(Yicai) June 6 — Buyers are enjoying steep discounts in China on foreign luxury autos such as those made by Cadillac, BMW, and Audi, as these carmakers fight back against fast-growing domestic brands such as BYD.

The BMW i3, a premium small electric vehicle, is on sale for CNY175,000 (USD24,000) at a BMW dealership in Beijing

Whist Cadillac were discounting the price of their ICE mode, BMW and Audi were cutting the margins on their luxury Ev range.

Then, a few days ago this China auto news piece appeared, again led by Yicai.

China’s Foreign Auto JVs Cut Prices by Up to USD13,800 Amid Stiff Competition

In this instance the chopper has been taken to the older ICE models in BMW, Audi, Mercedes Benz and VW range.

Retail sales of China’s top 10 auto JVs all fell in May. FAW-Volkswagen recorded the steepest decline of 17.5 percent, with the drops for SAIC Volkswagen and GAC Toyota at around 10 percent each, the CPCA data also showed. FAW Toyota fell out of the top 10.

While many JV showrooms did report an uptick in sales as a result of the cuts, this seemed to be largely driven by eh more conservative, older generation. Younger Chinese still voiced a preference to wait a little longer for the next Gen of smarter Chinese made EV’s. Perhaps the older gen view it against their remaining driving licence lifespan and see it as a fair investment. Many may also be put off by what they see as the increasing complexity of tech in NEV.

Whereas the younger Chinese also have an eye to the future, but are wary of China’s petrol cut off date. For them perhaps, the relatively short life span of an ICE vehicle in China is less attractive. They may also be more attracted to tech and idea of less time “driving” and more time to enjoy the journey?

Back in early 2023 we took a look at the Chinese auto situation and observed that whilst Chinese makers had or were switching to Electric, foreign, esp European marques were continuing to push their ICE models.

In September 2021 we also commented on this in depth and suggested an attitude of arrogance and complacency had crept into foreign makers thinking.

Curiously, the article also spoke of Volvo cars – now a Chinese owned company.

Now whilst we have seen a few Volvo EV’s around, they seem to be more SUV than the traditional Volvo sedan style. This segment seems to be taken over by Polestar – a Volvo subsidiary. So we are wondering if Volvo is following FORD in discontinuing its passenger range to only produce SUV’s in China whilst the rest of their operation focuses and the light and heavy truck market?

Polestar is a nice looking and well spec’ed vehicle, but we think their logo is a tad to close to that of Xiaopeng (XPeng) reminiscent of the similarity between Honda and Hyundai.

Other Ev news in China in Brief:

(Yicai) June 19 — Jaguar Land Rover signed a letter of intent with Chery Automobile to authorize their joint venture in China to produce electric vehicles under the UK auto giant’s Freelander marque.

More

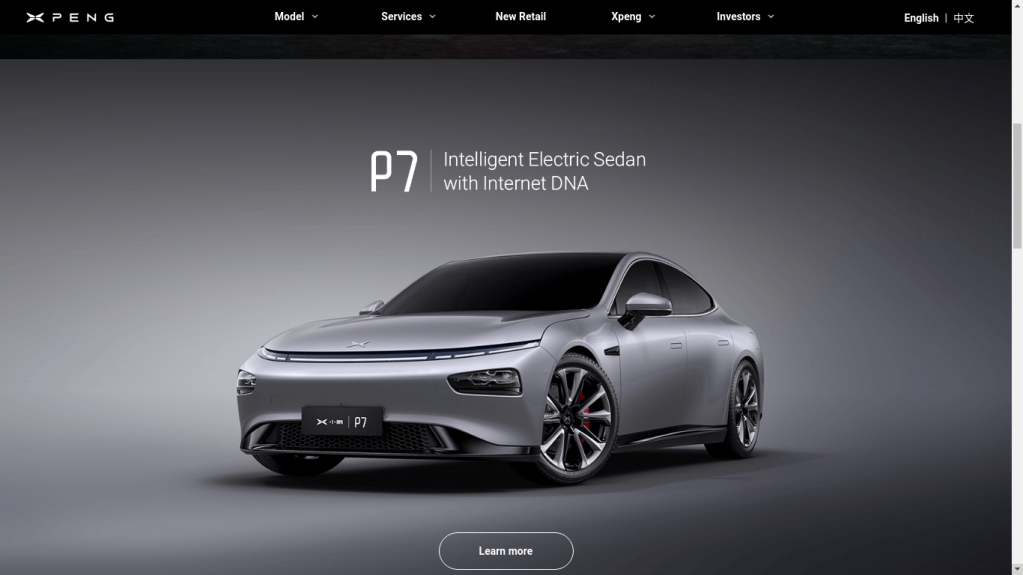

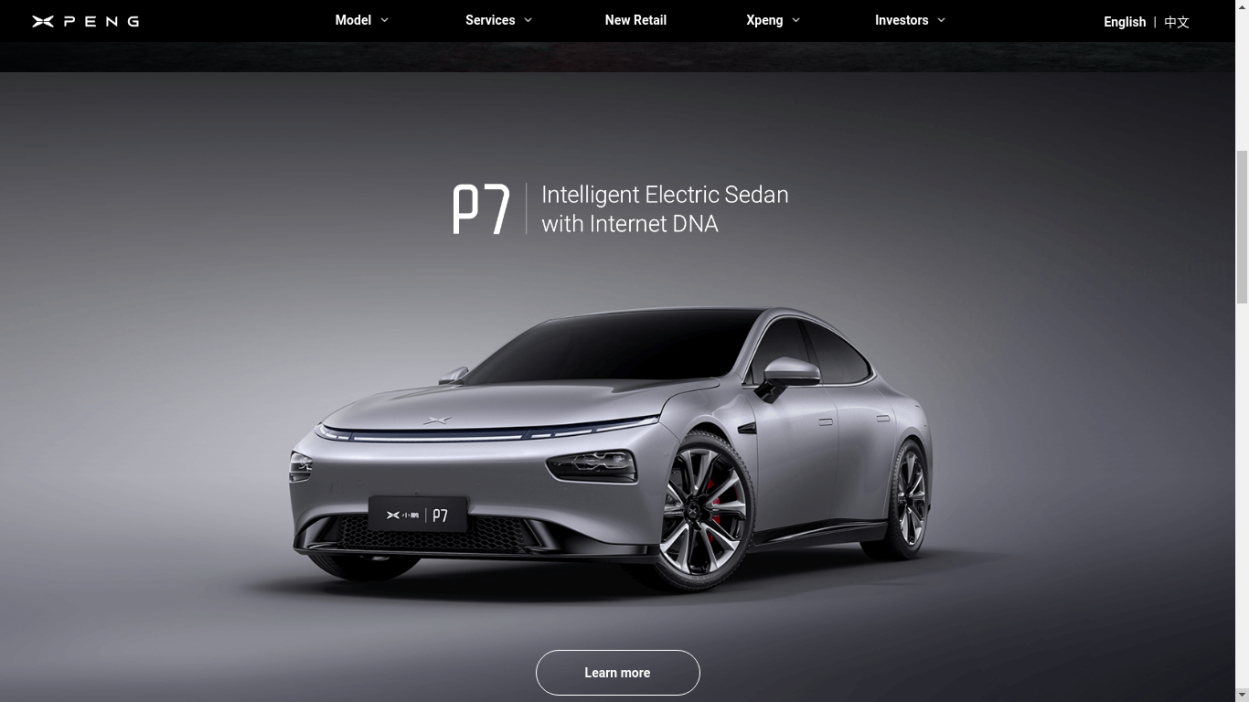

(Yicai) June 12 — Xpeng Motors has released two new energy vehicle models, the Xpeng G9 and Xpeng P7, into the Egyptian market, becoming the first Chinese NEV firm to launch pure electric autos in the Egyptian and African markets.

(Yicai) June 14 — Chengdu, a southwestern city with the most car owners in China, plans to phase out 300,000 old autos and replace them with more than 300,000 new energy vehicles over the next three years.

If China Ev news is your interest, YiCai Global Auto is one of the best sources of breaking stories and articles. Subscribe for free to know what is happening in this market sector soon as it happens.

If B2B Baidu Optimisation confuses you or you just want some background advice and information, give Ms Evelyne Yu a call. Free, friendly, expert, unconditional.

If you’d like to chat or need advise about negotiating the complex China marketing landscape, why not book a free, confidential, short chat with Everlyne Yu -CEO and founder of Uengager? Could be the best value 20 minutes you ever spent~

Contact us

Visit us

Tsinghua Xlab, Haidian District, Beijing

China

Get in touch

support@uengager.com

(01)-186-1176-5649

Leave a comment